Hiring New Staff: 5 Key Cost Factors To Consider

Congratulations! Business is good and it’s time to add to your staff. But if you’re thinking that the costs of bringing more people on have only to do with their salaries, you are sadly mistaken. Truth is, salary is just the tip of the iceberg—an iceberg that, if you’re not careful, could sink your budding business like the Titanic. So before you go interviewing prospective employees, take time to consider these five key cost factors when hiring new staff.

Payroll Taxes

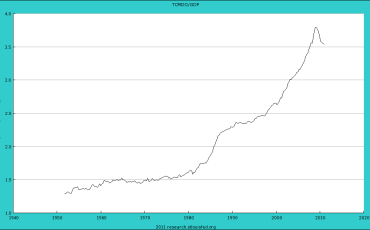

– Sure! Hiring new employees will increase your payroll. But don’t overlook the hit you’ll take from forking out payroll taxes. First off there’s social security tax, and you’ll be picking up half of that tab for each employee—at least for the first $117,000 of their annual earnings. Then there’s the 1.45 percent in Medicare tax you’ll be shelling out, with no cap on annual income. And don’t forget unemployment insurance. Then, depending on the state in which your business resides, you may need to purchase worker’s compensation insurance and withhold certain state and local taxes as well. All these taxes must be taken into account when deciding if it’s cost-effective to hire new employees.

Employee Benefits

– According to a 2013 report by the U.S. Bureau of Labor Statistics, the average employer cost of compensating an employee was $31.16 per hour. Wages and salaries accounted for 69.1 percent of that hourly figure, with the remaining 30.9 percent being attributed to the cost of employee benefits such as health insurance, retirement benefits, paid leave and supplemental pay. Being that health insurance accounts for roughly 8 percent of employee benefits costs, it’s important for employers to try to gain a better understanding of what impact the Affordable Care Act (Obamacare) will have on their future health insurance costs.

Employee Training

– Once the right employee has been recruited—and that’s a costly process in itself—proper training must be provided, which can have a hefty price tag as well. Obviously, the basic goal of training is to help the new employee learn their job and become as productive as quickly as possible. However, along with the costs of initial job training and orientation, the costs of providing performance support by management should also be factored in. That being said, proper training is well worth the costs, as inadequate training can lead to employee turnover, which if it becomes an ongoing occurrence can be catastrophically costly.

Workplace Integration

– Often overlooked when calculating the cost of hiring new staff are the costs of integrating the new hire into the workplace. The most obvious of these integration costs are desks, computers and other equipment and software needed for the performance of the job. However, workplace integration is also about helping new employees to find the right fit with their peers, a process which can be costly in itself. If hiring a new person involves investing in a new piece of expensive equipment, lease to own options should be considered to help reduce costs.

Office Expansion or Relocation

– At some point as a business continues to grow, hiring new staff will either mean adding additional office space at the existing location—if that’s possible—or relocating to a larger facility. Either way, the costs of physical expansion can be considerable, to the point that adding on or moving could jeopardize the solvency of the company. Office expansion or relocation should only occur after careful consideration of all factors involved, such as just how much adding new staff will benefit the business and justify the costs in the long run.

Robert Cordray is a former business consultant and entrepreneur with over 20 years of experience and a wide variety of knowledge in multiple areas of the industry. He currently resides in the Southern California area and spends his time helping consumers and business owners alike try to be successful. When he’s not reading or writing, he’s most likely with his beautiful wife and three children.